⏱ 5 min reading

First off, what is an invoice?

An invoice is a document or a notice you send to your customers/clients in order to notify them that a payment is due for goods you have provided them, or services you have performed. An invoice should ideally outline the description and quantity of the goods or services that were provided, along with their value. That determines how much you need to get paid!

So, let’s see what else needs to be included in an invoice and how we can go about creating one such invoice.

Basic requirements of an invoice

Although depending on the country that you and your clients are in and the legal status (i.e. Limited liability company, partnership, sole trader, etc) that you operate under, there are variations in what is required to be in an invoice, but generally, there are certain basic requirements that all invoices require. These requirements are as follows:

The Must Haves

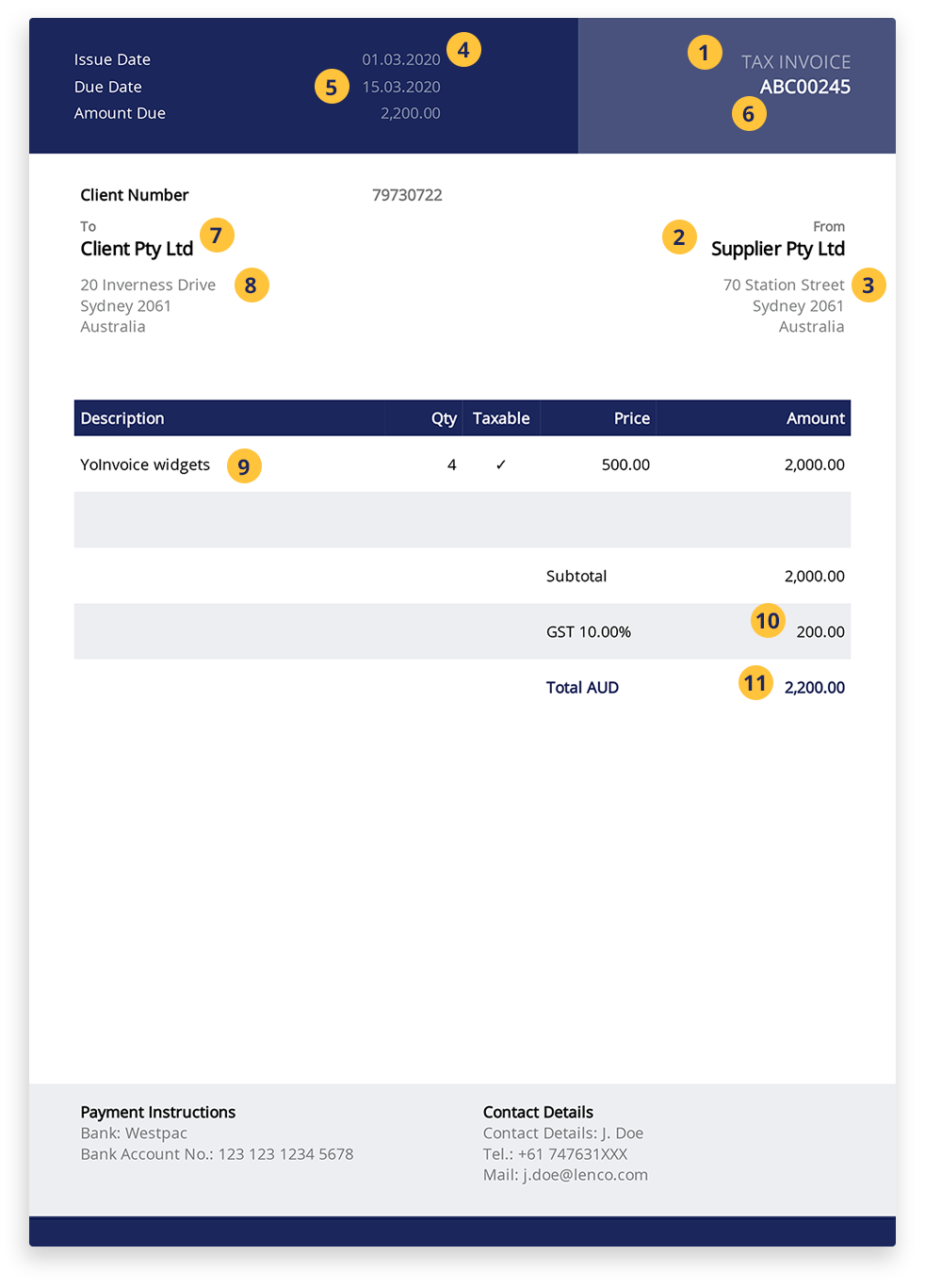

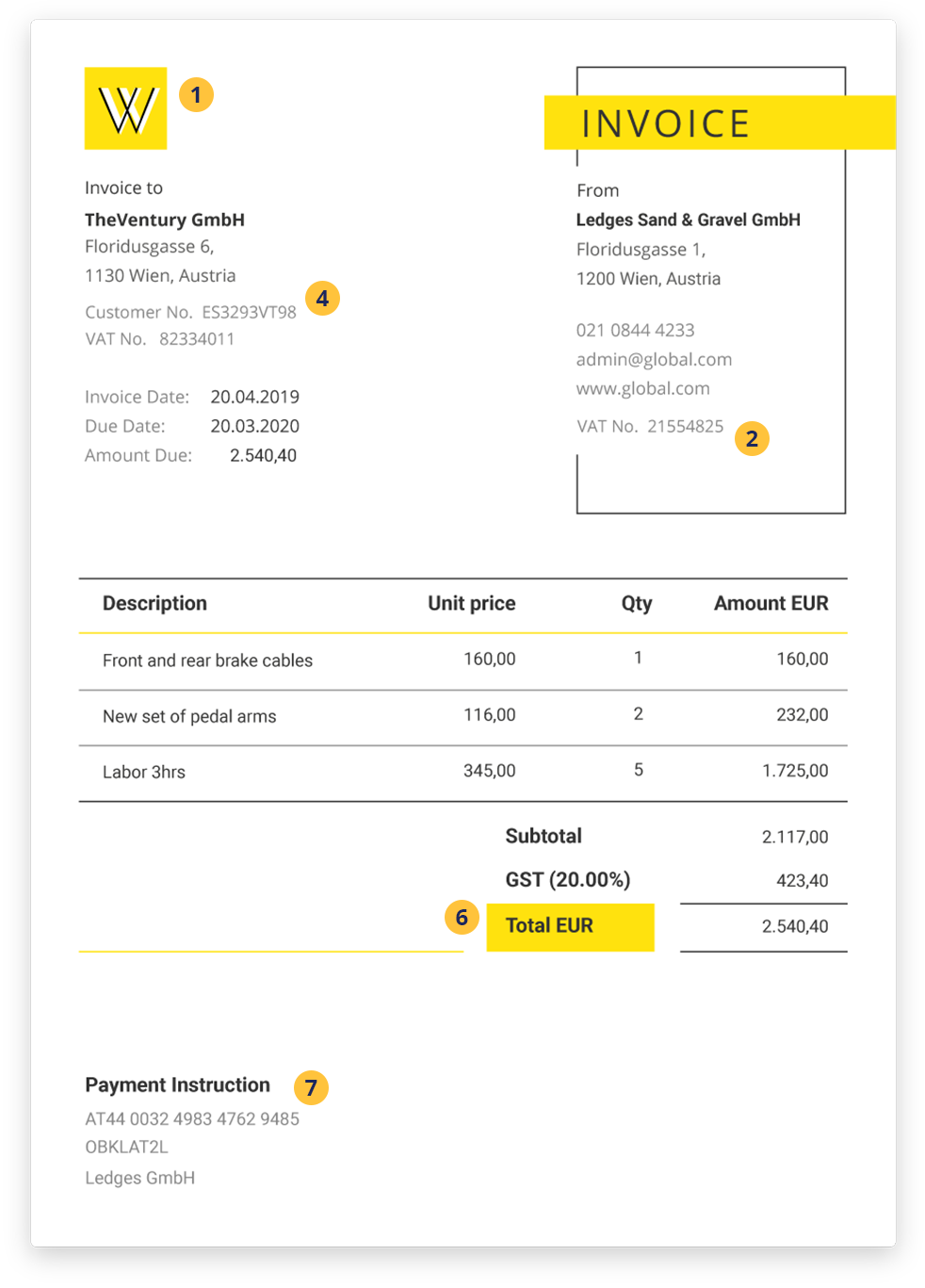

| 1 | The word “Invoice” or “Tax Invoice” | This needs to be clearly visible near the top of the document |

| 2 | The name of your business | If you are operating as a company, then the company name. If you are a freelancer, then your own name. |

| 3 | The date of the invoice | This can be the date that you create the invoice. |

| 4 | Your client’s name | Make sure you invoice the person or the entity who is supposed to pay you. |

| 5 | A clear description | List out the products and services that were provided, along with their quantity and price. |

| 6 | Total Amount Due | The full amount of payment required. |

The Should Haves

| 7 | A due date | When you need the client to pay you by. Alternatively, you can request for immediate payment upon receipt of invoice. |

| 8 | The Supplier’s address and contact details. | This can be the address and contact details of your place of operation, office or home office. |

| 9 | An Invoice number | A sequential set of numbers or letters that will help you identify the specific invoice. This can also come in handy if it is included during payment. It will make the identification and reconciliation process much easier |

| 10 | The client’s address and contact details. | This can be especially handy if there are others with similar names to your client. |

| 11 | VAT/GST amount | You need to mention the VAT/GST rate charged on the goods and services and the VAT/GST amount. In most cases, if you are preparing an invoice to a client in the same country, chances are that you will be charging them some sort of VAT (Value Added Tax), or GST (Goods and Services Tax) or something similar. There are exceptions to this and I will provide more details later on in this article. |

| 12 | The Gross and Net amounts | The “Gross amount” includes VAT/GST and the “Net Amount” excludes VAT/GST. |

With the check list above, in most cases, you should have everything that is required of a basic invoice. But there are some additional things that you need to be aware of:

BONUS

| 1 | Logo | Although not required, but it could add some colour to your invoice and make it stand out. |

| 2 | Your VAT/GST number | Depending on the country that you operate in, you may have to register for VAT/GST. If you have done so already, you are required to include your VAT/GST number on the invoice. You can find some basic information on different countries’ VAT/GST requirements and thresholds by clicking HERE. |

| 3 | Client’s VAT/GST number | In some countries (mainly within the EU), it is recommended that you also include the client’s VAT/GST number if it is a B2B (business to business) transaction. |

| 4 | Unique Identification Number | In some countries, if your business has a UIN (Unique Identification Number), or a Company registration number, you are required to provide that on the invoice. |

| 5 | State taxes (if in US) | If you are based in the United States, you should look into the relevant state taxes for you and your client. |

| 6 | Currency | The currency used |

| 7 | Payment instructions: | This can be your bank account details or a note requesting payment in the form of cash for example. |

How to create an Invoice

Now that we have covered what are the requirements of an invoice, let’s get into how we can create one.

If you are already using an accounting software, they should already have an invoicing function with instructions on how to use it. But the majority of freelancers and micro-business owners, do not tend to use accounting software and as such, have to find other ways for creating an invoice.

Rather than creating an invoice from scratch, using software such as WORD or EXCEL, most people rely on using already created templates, freely available on the internet. Examples of such templates can be seen HERE.

Once you have filled out the templates, you can then create a pdf file or print them off and send them to your client

YoInvoice – Your Professional Invoices

Another even easier and more convenient solution, would be to use online invoice generators such as Yoinvoice, where you can easily generate professional invoices for FREE. One can use the website without any registration, and create an invoice within minutes.

All you have to do, is to input the information mentioned above, into the relevant fields, and at the end of it, you can either generate a pdf file, and/or directly email the invoice to your client.

And just like that, you can start creating your own professional invoices.

I hope you have found this article helpful. If you have any further questions, please leave a comment, or suggest us other topics you would like us to cover in our future articles.